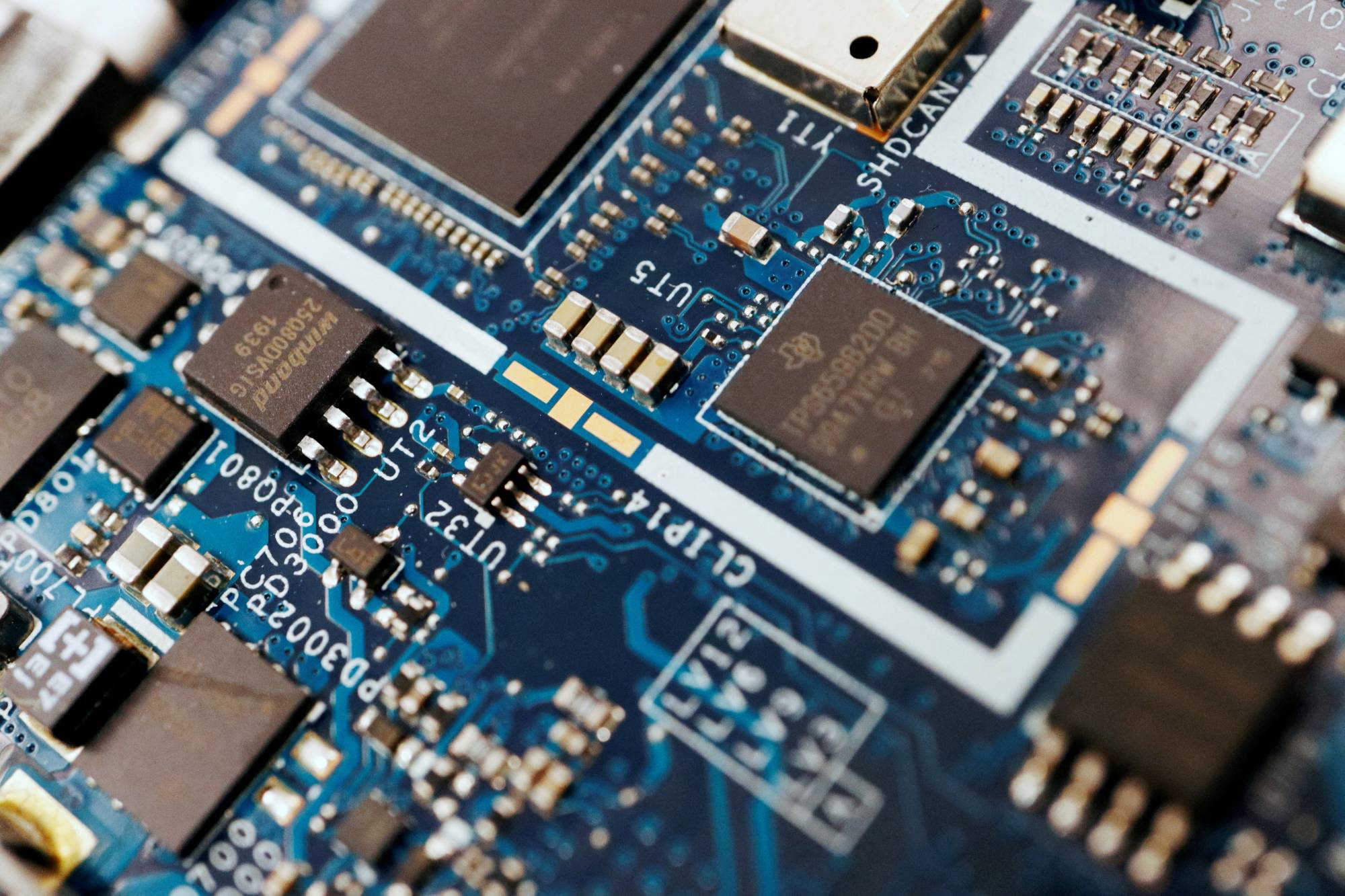

China’s grey market for semiconductors was exposed during the Covid-19 era. However, the recent impositions by the United States and its associates could awaken more scrutiny for these products.

Bloomberg recently provided a review of how China gained popularity when automakers scrambled for semiconductors and MCUs during the peak of the Covid pandemic.

In the story, this business in China involves regulated companies that sell out-of-date and second-hand chips through the help of middlemen. However, there are irregular practices that take place which involve brokers hoarding the chips and gouging the prices, which is contrary to China’s regulations.

Another malpractice involves backdoor sales where authorized agents sell at exaggerated prices, the chips that they have ordered in surplus.

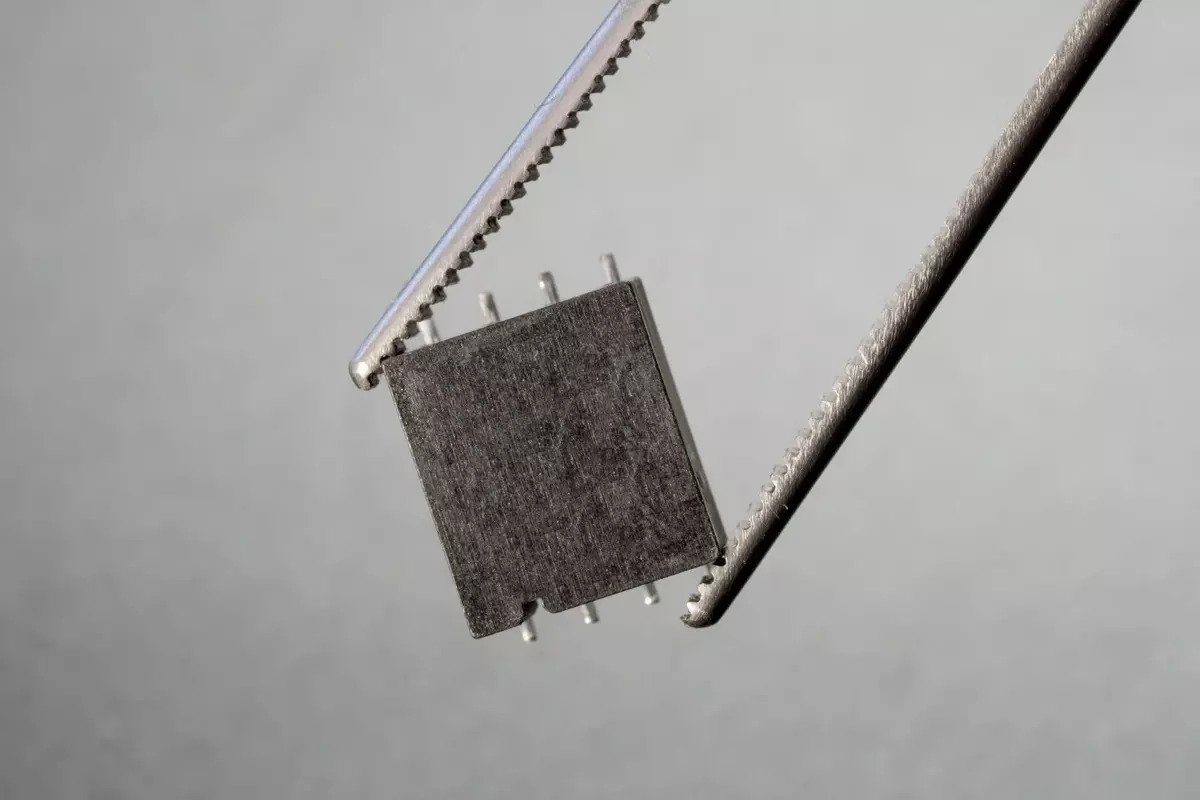

This is critically analyzed through an unfortunate example where an SUV maker, Li Auto, in Beijing bought a chip at $500 during the pandemic. The same chip used in the electronic braking systems used to sell at $1 before the pandemic happened.

China’s grey market has been a lucrative one for the time being, but changes are bound to occur especially with the new regulations that the US and its allies have taken against China’s technology sector.

The biggest elephant in the room is whether the underground market will manage to sell the chips for AI and high-performance computer designs which are a great necessity at the moment. In addition, it is not clear whether the brokers will maneuver the supply chain restrictions in the chips industry.

In the imposed regulations, there is a high likelihood that the out-of-date designs will not be valuable anymore. The regulations might also affect the underground activities conducted by brokers, who might be forced to devise new mechanisms of conducting their business.

Nonetheless, the underground chip market in China is bound to grow, owing to the rising demand for these products, especially in the AI sector.